Global Position and Growth Background of Korea Clinical Trials

Korea is one of the countries that stands out in the global clinical trial market led by international pharmaceutical companies. As of 2024, sponsor-initiated clinical trials conducted in Korea account for about 3.46% of the world total, ranking 6th after the United States, China, Australia, Spain, and Germany. Notably, Seoul held the number one position worldwide for the number of clinical trials conducted by city from 2017 to 2023, and in 2024 it remained 2nd (after Beijing), solidifying its status as a major clinical trial hub. This achievement is the result of government policies since the early 2000s that recognized clinical research as a pillar of economic growth and actively worked to strengthen clinical trial capabilities. In fact, the annual number of clinical trials in Korea grew explosively from 48 in 2000 to over 1,000 in 2021, far exceeding the global average growth rate.

Korea’s clinical trial infrastructure has been built on a high level of standardization and systematic government support. The Ministry of Food and Drug Safety (MFDS) enforces strict regulations, and support organizations such as the Korea National Enterprise for Clinical Trials (KoNECT) facilitate site accreditation, investigator training, and data standardization. Nationwide, around 200 medical institutions have been designated by the MFDS as certified clinical trial sites, and many of these are large hospitals with over 1,000 beds that can leverage abundant patient resources. Korea became a full member of the International Council for Harmonisation (ICH) in 2016, quickly adopting global guidelines, and since implementing Good Clinical Practice (GCP) guidelines in 1995 it has continually reinforced its clinical trial quality management system. As a result, in the 39 on-site inspection audits that the FDA conducted in Korea since 2008, not a single Official Action Indicated (OAI) finding was issued, maintaining an excellent record of quality. Thanks to these strong institutional and infrastructure foundations, numerous global pharmaceutical companies have chosen Korea as a key base for early-stage clinical development, actively leveraging the country’s strengths in partnership with Korean contract research organizations (CROs).

Basic clinical trial information is also available on Intoinworld’s clinical trial information page. Building on this foundation, the goal of this report is to provide an overview of the entire process of conducting Phase I/II early-phase trials in Korea and to derive strategic advantages and considerations by comparing key metrics—such as regulatory lead times, infrastructure, patient recruitment, and costs—with those of other countries.

Study Design and Preparation Phase

The starting point for a Phase I/II clinical trial is a rigorous study design. The protocol is developed considering the characteristics of the investigational new drug and its stage of development, with Phase I trials focusing primarily on safety and pharmacokinetic (PK) evaluation. For example, in the case of a small-molecule drug, the first-in-human dose may be administered to healthy volunteers, or for an oncology drug, an initial dose is given to a patient cohort to determine the maximum tolerated dose (MTD) and characterize the adverse event profile. In Phase II trials, the focus shifts to exploring efficacy signals and determining the optimal dose by evaluating preliminary therapeutic effects in the target patient population. In Korea, there is a preference to design early-stage trials in alignment with global development strategies; in the case of multinational pharmaceutical companies, a “bridging” strategy is sometimes used to integrate Korean trial data into the global development plan. Recently, methodologies such as adaptive designs or seamless Phase 1/2 integrated designs have been adopted to shorten development timelines, thereby blurring the boundaries between trial phases and increasing agility in drug development.

During the study design phase, thorough advance preparations are carried out in parallel, taking into account the Korean healthcare environment. Most large hospitals have dedicated clinical trial centers, and professional coordinators, pharmacists, data managers, and others participate from the early protocol development stage. Following standard operating procedures (SOPs), they establish detailed plans for case report form (CRF) development, data management, investigational medicinal product (IMP) handling, and other operational aspects. For multi-center trials, participating institutions are selected and investigator recruitment is facilitated by conducting feasibility studies. Because Korea has a universal national health insurance system with fully digitized patient records, analyzing the patient pool via electronic medical records (EMRs) and forecasting enrollment timelines is relatively straightforward. For instance, major tertiary hospitals in Korea see over 10,000 outpatients per day, and can identify suitable patient groups through data to inform recruitment strategies. Through such upfront preparations, Korean clinical trial sites lay the groundwork for top-tier performance in patient recruitment speed and data quality globally.

Regulatory Approval Procedures: MFDS IND and IRB Review

Once the protocol is finalized, a formal regulatory approval process must be completed. In Korea, before initiating a trial, one must obtain MFDS approval of the clinical trial plan (IND) and simultaneously secure approval from the Institutional Review Board (IRB) at each investigative site. For IND approval, the submission dossier includes the clinical trial protocol, investigator’s brochure, investigational product information (manufacturing and quality data, etc.), and informed consent forms, which are prepared and submitted to the MFDS. The MFDS is required to review the IND within 30 working days, and in practice approval is generally granted in about 4–6 weeks. IRB reviews proceed in parallel according to each institution’s schedule; in large hospitals, IRB meetings are held 1–2 times per month, and approvals are typically obtained in around 3 weeks on average. Recently, for multi-center trials, a system has been introduced whereby a central IRB’s decision is mutually recognized by other sites, allowing ethical reviews across multiple institutions to be shortened simultaneously.

Korea’s regulatory authority (MFDS) has gained competitiveness through rapid and transparent reviews. In 2002, the MFDS separated the IND review process from new drug (NDA) review and reduced the IND review timeline to 30 working days, thus lowering the barrier to trial startup. In 2019, a five-year clinical trial development plan was announced, which included the introduction of a pre-IND consultation system to encourage early-phase trials. Through these pre-IND meetings, a sponsor can hold informal consultations with the MFDS on key issues and share safety data before the official IND submission, which has in some cases shortened the formal review period from 30 days to as little as 7 days. The MFDS’s expedited review practices clearly outpace those of Japan’s PMDA (typically 10–12 weeks) or China’s NMPA (typically 12–16 weeks, with potential policy-related delays). For example, in one global Phase II oncology trial conducted by a multinational company, IND approval in Korea took 7 weeks, whereas in China it required about 4 months. Overall, Korea’s regulatory lead time is on the order of 8 weeks, placing it among the fastest in the world, and by conducting IRB reviews in parallel the total startup preparation time is only about 4–8 weeks.

While the regulatory approvals are underway, each site carries out final preparations before trial initiation. For example, the sites finalize the approved version of the patient informed consent form, prepare for investigational product distribution, and convene an investigator meeting to train the principal investigator and sub-investigators. Once MFDS IND approval is received and all sites have IRB approval, the required conditions are considered met and the trial can officially begin. After that, the enrollment of the first participant (First Patient In) marks the formal launch of the Phase I/II study.

Participant Recruitment and Clinical Trial Conduct

Patient recruitment is a critical factor that determines the success of Phase I/II trials, and Korea’s healthcare environment offers very favorable conditions. As mentioned, with a nationwide health insurance system, healthcare utilization is high and patient data are systematically accumulated, so the target patient pool can be identified with ease. Most trials are conducted at large tertiary hospitals, and the clinical trial centers at these hospitals maintain internal databases and collaborative networks that allow efficient access to patients with the relevant conditions. As a result, the subject enrollment speed in Korea is reported to be about 25% faster than the Asian average, placing Korea among the top globally in recruitment speed. In one case, a trial in Korea enrolled 500 participants in 3 months, whereas in Japan recruiting the same number (500) took 8 months, a striking difference. Additionally, not only is recruitment rapid in Korea, but the drop-out rate is low, meaning once a participant is enrolled, they are very likely to stay through to the end of the study — another major advantage of Korea’s trial environment.

Clinical trial conduct in Korea is carried out in a standardized manner under strict GCP compliance. Phase I trials in Korea are typically conducted at specialized clinical pharmacology units designated by the MFDS. Currently about 26 dedicated Phase I units are in operation nationwide, and major university hospitals (such as Seoul National University Hospital) run state-of-the-art clinical pharmacology centers equipped with advanced medical equipment and specialized staff. These centers are fully equipped with resources including inpatient beds (over 700 across the country) for safety monitoring during dosing in healthy volunteers, drug concentration analysis laboratories, and emergency response facilities. During trial execution, professional monitors (CRAs) continuously oversee the sites, and quality managers perform internal audits to continually evaluate data completeness and accuracy. Importantly, Korea has made significant efforts to train and retain specialized personnel like research nurses and clinical trial coordinators; all clinical trial staff must complete mandatory annual GCP training, which elevates the entire study team’s compliance capabilities. Furthermore, many institutional IRBs have international accreditations (e.g., FERCAP, AAHRPP), enforcing rigorous ethical standards so that in terms of protecting participant rights and welfare, Korea meets global levels.

With this infrastructure and operations in place, a sponsor can expect data quality and regulatory compliance in Korea equivalent to what they would at home. Korean investigators are well-versed in ICH-GCP and FDA guidelines, running trials to the same standards as in the US or Europe, yet with much greater cost efficiency. Indeed, it has been noted that conducting trials in Korea can achieve the same quality at only about 60–70% of the cost of doing so in the United States (details of this will be discussed in the international comparison section). In summary, Korea’s trial execution infrastructure can be described as an environment that offers “U.S.-level technology and quality at under 70% of the cost.”

Data Management and Final Reporting

Data management of the clinical trial outputs is also one of Korea’s strengths. All trial data are managed in accordance with ICH E6(R2) international standards, and most research sites utilize electronic data capture (EDC) systems. Owing to the high level of hospital digitization in Korea, integration between EDC systems and hospital electronic medical records (EMRs) is seamless, greatly reducing data entry errors. One analysis found that linking to EMRs reduced data errors by up to 90%, which in turn shortens the time required for data cleaning and enables rapid availability of high-reliability data. Data managers validate data in real time through monitoring and query management, and they make immediate corrections when necessary. Additionally, major institutions are equipped with central laboratories and biomarker analysis facilities, so that biological samples collected during trials are processed in a centralized, standardized manner, ensuring consistency of data.

At the completion of a trial, close-out visits are carried out for each participant to perform final data checks and wrap up any follow-up monitoring. Afterward, closure reports are submitted to each site’s IRB, and a clinical trial results report must be submitted to the MFDS as well. Under Korean regulations, the MFDS must be notified of trial completion results within 30 days, so a final report containing the study’s key outcomes, adverse event reports, and a data summary is prepared and submitted accordingly. In global trials, data generated in Korea are integrated into the global database and used in regulatory submissions worldwide. Thanks to their high accuracy and rich patient information, data from Korea are well-suited for global new drug approvals and are frequently included in FDA or EMA submissions.

The high quality of data management in Korea has been demonstrated through inspections by international regulators, as mentioned earlier. The U.S. FDA conducted on-site inspections of Korean trial sites 39 times between 2008 and 2019, and the result was that not a single Official Action Indicated (OAI) finding was issued. This record illustrates that the integrity and reliability of Korean clinical trial data are at a global standard, and is attributed to rigorous internal quality assurance (QA) and a collective “quality-first” culture among all staff. In conclusion, data from Phase I/II trials conducted in Korea possess world-class integrity and are delivered to regulators and stakeholders in a timely manner, thereby helping to drive development timelines forward.

International Comparison: Approval Timelines, Recruitment Speed, and Cost

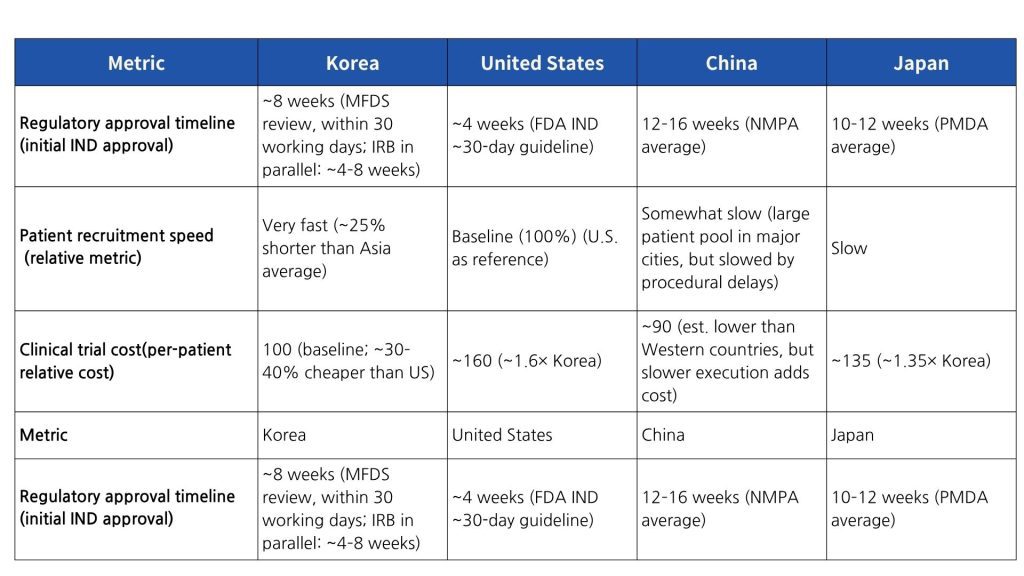

To more clearly understand Korea’s clinical trial environment, it is useful to compare some key indicators with those of the United States and other major countries. Table 1 provides a comparison of approximate metrics for Korea versus the US, China, and Japan in terms of regulatory approval duration, patient recruitment speed, and clinical trial costs.

As shown in Table 1, Korea’s MFDS IND approval lead time is under 8 weeks on average—slightly longer than the US FDA’s roughly 4 weeks, but dramatically faster than in Japan or China. Moreover, conducting IRB reviews in parallel and the adoption of a central IRB system have shortened multi-site approval periods, making the time to First Site Initiation among the shortest globally. In terms of patient recruitment, Korea’s high healthcare accessibility and population density enable much faster enrollment compared to the US or Japan. In particular, Japan’s elderly population (~28% aged 65 or older) makes it difficult to recruit eligible subjects for some diseases; in contrast, Korea’s comparatively younger demographics and high willingness to participate translate into highly efficient recruitment. In terms of cost, Korea manages to maintain quality while also achieving cost competitiveness. According to global CRO market reports, the cost of conducting trials in Korea is 30–40% lower than in the US, 10–20% cheaper than in Taiwan or Singapore, and about 35% lower than in Japan. In other words, if the cost index for a given trial is 100 in the US, the same trial can be conducted in Korea for on the order of 60–70. This cost efficiency is driven by reasonable personnel and hospital fees and improvements in operational efficiency through digitalization. Furthermore, the high data accuracy in Korea reduces the need for additional monitoring, contributing to overall cost savings.

Overall, Korea offers the winning combination of “fast approvals, rapid recruitment, and reasonable costs,” providing an attractive environment for early-phase clinical trials. This level of competitiveness is not only superior to neighboring countries like China and Japan but is among the highest globally. Indeed, many global pharmaceutical companies are choosing Korea as a key clinical development hub to take advantage of these strengths.

Recent Trends: AI-Based Design and the GIFT Program

There is a growing effort to further improve trial operational efficiency through the use of artificial intelligence (AI) and digital technologies. AI can assist in identifying optimal trial designs and selecting patient cohorts by analyzing vast amounts of clinical data, and it is also being applied to adaptive trial operations via real-time monitoring. According to McKinsey, training AI on historical trial data can allow more precise identification of eligible patient characteristics for new trials, potentially shortening trial preparation time by 15–20%. Additionally, AI-based simulation can be used to set up virtual control arms or optimize trial endpoints, making it possible to reduce overall trial duration by up to 15–30%. Thanks to these innovations, it has been reported that around 2025 the first clinical trial designed by AI is expected to launch — a sign that AI utilization is emerging as a new paradigm in trial design. The Korean pharmaceutical and biotech industry is also actively investing in AI-driven drug development; for example, collaborations such as Hanmi Pharmaceutical–Aizen Science and Oncocross–domestic pharma partners have been establishing AI drug development platforms. In clinical operations, efforts are underway to incorporate AI tools for protocol optimization, automated patient screening, and early detection of warning signals, with the aim of enhancing both efficiency and safety. In summary, AI-driven trial design and operations represent cutting-edge trends that drive speed and cost reduction, and their use is expected to expand in Korea’s clinical trial environment moving forward.

On the regulatory side, the GIFT program has attracted attention as a means to expedite the development and approval of innovative medicines. GIFT (Global Innovative Products on Fast Track) is an accelerated review support system introduced by the MFDS in 2022, designed to shorten the drug approval review period by 25% (target 120 days → 90 days) for innovative new drugs intended for life-threatening or serious diseases. To achieve this, the MFDS designates such products as fast-track from the early development stages and, upon the developer’s request, provides close one-on-one consultation on data preparation. It also employs a rolling review by accepting only the most critical data (e.g. key safety information) first and then sequentially reviewing additional data as they become available, thereby allowing the approval review process to begin even before the completion of Phase III trials. Furthermore, for a drug designated under GIFT, a dedicated review team is assembled within the MFDS to communicate closely with the sponsor and manage the review timeline, greatly reducing the time the developer must spend on regulatory interactions. As a first outcome of the GIFT program, in November 2022 Roche Korea’s non-Hodgkin lymphoma treatment Lunsumio (mosunetuzumab) became the inaugural designee. This drug was selected in consideration of the urgent medical need, as it is an innovative therapy in a rare disease area with no existing treatment in Korea. Since then, numerous anticancer and orphan drugs have received GIFT designation and enjoyed accelerated development and approval benefits; by mid-2023, a total of about 50 products were reported to have been included in this fast-track. The GIFT program is also part of MFDS’s efforts toward international harmonization of regulatory processes, by applying global standards concurrently in domestic reviews. Through this, the ultimate goal is to support innovative drugs developed in Korea in making a swift transition from domestic approval to entry into overseas markets.

These introductions of AI technology and the implementation of the GIFT system are creating new opportunities for conducting Phase I/II trials in Korea. Leveraging AI can enable more efficient trial designs with a higher probability of success, and through GIFT, early clinical achievements for an innovative drug can more rapidly translate into product approval. By taking advantage of these two trends, clinical trial practitioners can save time and cost while maximizing the strengths of Korea’s trial environment.

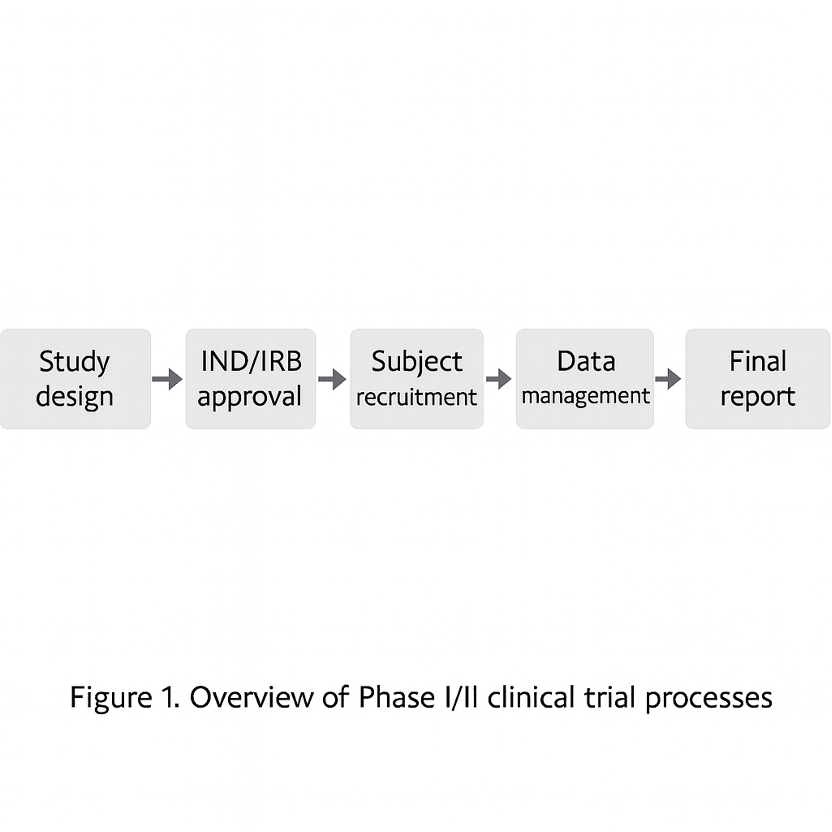

Figure 1. Overview of the Phase I/II clinical trial process: The diagram illustrates the workflow from study design → IND/IRB approval → patient recruitment → trial conduct → data management → final reporting. In Korea’s early-phase trials, each of these steps is supported by specialized personnel and standardized processes, which enhance overall quality and efficiency. The data and outcomes generated at each stage inform decision-making in the next stage, ultimately maximizing the likelihood of successful drug development.

Conclusion and Strategic Implication

In summary, when examining Korea’s clinical trial environment and Phase I/II procedures as a whole, the strategic advantages are clear. First, in terms of regulatory lead time, the rapid and predictable approval processes by the MFDS and institutional IRBs greatly contribute to accelerating development schedules. Second, a high-quality nationwide healthcare infrastructure and abundant patient pools centered around large hospitals support fast subject recruitment and low drop-out rates, increasing the probability that trials can be completed within the planned timeline. In terms of quality, data from trials in Korea meet international regulatory standards and, as demonstrated in past cases, have high global credibility. Nonetheless, costs are markedly competitive compared to Western countries, meaning the same budget can cover more patient enrollment or additional analyses – a very attractive aspect. Furthermore, by proactively embracing the latest innovations such as AI utilization and the GIFT program, Korea is fostering an environment that maximizes trial efficiency and success rates, evolving into a “smart trial” hub in the early-phase development stage.

Of course, there are challenges that need to be overcome. First, competitor countries are continuously catching up in the global clinical trial market, which could narrow the relative edge Korea has enjoyed. For example, China has recently overtaken Seoul as the top city for clinical trial activity by leveraging its massive patient population, and countries like Singapore are emerging as niche leaders by improving regulatory efficiency and cultivating specialized personnel. This intensifying competition could lead to challenges within Korea as well, such as competition among sites for patient recruitment or rising labor costs that change the cost structure. Second, given the nature of early-phase trials, there are always risks like unexpected safety issues or decisions to halt development, and Korea is not immune to these. However, Korea’s regulatory authorities encourage swift response and transparent communication in such situations, so even in a crisis the issues can be managed relatively stably. Third, foreign pharmaceutical companies entering Korea must consider the possibility of missteps due to language and cultural differences. For instance, if the trial consent form is not accurately translated into the local language, if communication with medical staff is not smooth, or if local regulations are not fully understood, problems can arise. To reduce these risks, it is important to collaborate with a CRO that has extensive local experience or to seek consulting from specialized organizations like KoNECT.

In fact, many global companies find that selecting a reliable Korean CRO as a partner for trial operations is one of the best ways to minimize the above-mentioned pitfalls and adapt quickly to the local environment.

Based on the above, the strategic recommendations for successfully conducting early Phase I/II trials in Korea can be summarized as follows:

Utilize pre-submission consultation: From the initial planning stage, actively utilize the MFDS pre-review system (pre-IND meeting) to reduce potential regulatory risks and shorten approval timelines.

Establish local networks: Proactively build collaboration frameworks with major clinical sites and use those institutions’ patient data to develop a realistic recruitment plan.

Adopt digital innovation: Introduce digital technologies such as AI to optimize protocol design and automate subject screening, thereby simultaneously shortening development time and increasing success rates.

Leverage the GIFT track: For eligible innovative new drugs, conduct early-phase trials in Korea and obtain fast-track designation (GIFT) to greatly reduce time to market.

Engage expert partnerships: When expanding into Korea, do not overlook local regulatory nuances or cultural differences; work with an experienced local CRO (such as Intoinworld) or specialized institutions to carefully navigate procedures.

In conclusion, Korea provides an optimized platform for early-phase clinical trials based on three major strengths: a high level of regulatory expertise, outstanding patient accessibility, and a cost-effective structure. If clinical trial professionals understand these characteristics and procedures of the Korean market and plan strategically, they can significantly shorten the journey from the First-in-Human stage to proof-of-concept. In other words, conducting Phase I/II trials in Korea can be a strategic choice that goes beyond simple cost savings to actively accelerating global clinical development and improving the likelihood of success.

Frequently Asked Questions (FAQ)

Q1. How long does the clinical trial approval process (IND and IRB) take in Korea?

A1. In Korea, MFDS approval of a clinical trial application (IND) is legally required within 30 working days and in practice is usually obtained in about 4–6 weeks, while an institutional IRB ethics review typically takes around 3 weeks. Fortunately, IND review and IRB review can be carried out in parallel, so the total preparation time until trial initiation is generally only about 6–8 weeks, which is a much faster startup time compared to Japan or China and is one of Korea’s major strengths. Moreover, by taking advantage of the MFDS pre-IND consultation system, the formal IND approval period can be shortened to around 1 week in some cases.

Q2. Why is patient recruitment faster in Korea?

A2. The biggest factors are healthcare infrastructure and population demographics. Korea’s universal health coverage means very high healthcare accessibility, and large hospitals have well-established patient databases and collaboration networks that excel at quickly finding eligible participants. For example, major hospitals in Korea often have pre-identified pools of patients for specific diseases, making subject screening and enrollment extremely efficient. Empirically, Korea’s enrollment speed is about 25% faster than the Asian average, allowing much shorter recruitment periods than in the US or Japan. In addition, Korean patients tend to be highly willing to participate in trials and have low drop-out rates, meaning once enrolled they are likely to remain through completion. These factors combined place Korea among the top tier globally in terms of patient recruitment speed.

Q3. What are the benefits of collaborating with a Korean CRO?

A3. Partnering with a local Korean CRO (such as Intoinworld) is extremely valuable for overcoming language and cultural barriers and adapting quickly to the local system. An experienced Korean CRO has a deep understanding of MFDS regulations and procedures, which helps facilitate smooth document preparation and regulatory interactions, and it possesses networks with major hospitals and investigators to efficiently support recruitment and site management. Moreover, the CRO acts as a communication liaison between the sponsor and the study teams, reducing potential misunderstandings or trial-and-error. This is especially important in early-phase trials, where even small mistakes or delays can impact the overall development timeline—the expertise of a Korean CRO is a major asset for managing these risks. In sum, forming a partnership with a trusted local CRO can improve both the quality and speed of trial operations, and effectively solve many practical challenges that foreign sponsors may face when conducting trials in Korea.